us germany tax treaty withholding rates

The new tax treaty replaces the treaty signed on 9 July 1962. The Protocol would continue the existing general limitation of withholding tax on dividends paid by a US.

Canada Tax Income Taxes In Canada Tax Foundation

The complete texts of the following tax treaty documents are available in Adobe PDF format.

. Withholding rates by country Last updated on Mar 9 2022 This page contains information on tax withholding rates for countries with tax treaties with the US. The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt. A reduced rate of withholding applies to a foreign person that provides a Form W-8BEN or W-8BEN-E claiming a reduced rate of withholding under an income tax treaty only if the foreign person provides a US.

A new tax treaty between Israel and Germany is effective as of 1 January 2017 in force since 9 May 2016. Double taxation agreements between territories often provide reduced WHT rates. This makes it possible for instance for the IRS to see what income taxes a US.

The rate is 49 for interest derived from i loans granted by banks and insurance companies and ii bonds or securities that are regularly and substantially traded on a recognised securities market. With respect to the capital gains tax the double taxation treaty signed by Germany and the United States provisions that a German company holding real estate in the United States may be taxed in the United States. Information is provided as a courtesy and is not guaranteed to be up to date.

Or foreign Taxpayer Identification Number TIN except for certain marketable securities and certifies that the foreign person. Other Tax Rates 2 Non-Resident Withholding Tax Rates for Treaty Countries 133 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 France 10 515 010 25 Gabon 10 15 10 25 Germany 10 515 010 025 Greece 10 515 010 1525 Guyana 15 15 10 25 Hong Kong 10 515 10 25 Hungary 10 515 010 101525 Iceland 10 515 010 1525. How the German-American Tax Treaty Works in Practice.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Germany - Tax Treaty Documents. An election can be made to treat this interest income as if it were industrial and commercial profits taxable under article 8 of this treaty.

In all other cases the dividend tax is 15. Over 95 tax treaties. Tax treaty signed but not yet applied Non-treaty countries.

The German federal government in January 2021 adopted a draft bill to modernize the provisions for relief from withholding tax and the certification of capital gains tax. 152 rows Quick Charts Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by companies in WWTS territories to residents and non-residents are provided. The United States withholding rate on such dividend to German investors will remain at 15 percent.

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US. Article 10 2 generally limits the rate of withholding tax in the State of source on dividends paid by a company resident in that State to 15 percent of the gross amount of the dividend.

In fact under a 2006 amendment to the US-Germany income tax treaty the governments of both countries are allowed to share tax information with one another. Corporate Income Tax Rate. Tax on loans secured on German property is not imposed by withholding but by assessment to corporation tax at 15 plus solidarity surcharge of the interest income net of attributable expenses.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. For this 15 th edition we have looked at 124 countries and analyzed the WHT rates applicable on interest dividends and capital. Up to 10 branch tax may be imposed on PE profits.

Corporate Tax Rates 2022 Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States. Non-resident corporations can apply to the Federal Central Tax Office for a 40 refund bringing the dividend withholding tax rate down to the CIT rate of 15 plus the solidarity surcharge resulting in an effective 15825 rate.

A treaty may stipulate a higher rate. Withholding tax and capital gains tax. The rate is 15 10 for Bulgaria.

Germanys default interest withholding tax rate is 0. Except for China and Singapore which apply a flat WHT rate of 75 to dividend payments and the Philippines which applies a flat WHT rate of 10 on dividends the treaty WHT rates for dividends under the post 1999 DTAs is 75 for dividends where the recipient controls at least 10 of the voting power of the Nigerian company paying the. Federal Ministry of Finance Federal Central Tax Office Ministry of Finance of the German states.

These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. Corporate Capital Gains Tax Rate. 30 for Germany and Switzerland for contingent interest that does not qualify as portfolio interest.

Special transition period of and germany tax us treaty rates and those in the united states is that state by interest. Under the new tax treaty the following rates apply. Signed the OECD multilateral instrument MLI on July 7 2017.

The same provision applies to US companies holding real estate in Germany. Corporation to 15 if paid to a German resident and to 5 if paid to a German corporation that owns 10 or more of the voting. The KPMG Luxembourg Withholding Tax Study analyzes the withholding tax WHT rates of different jurisdictions with respect to Luxembourg investment funds offering you a snapshot of each jurisdictions situation.

Progressive rates from 14-45. Citizen living in Germany is paying in that country. Have US tax withheld Generally a.

Provisions of the existing convention permit German resident investors to make portfolio investments in the United States through United States Regulated Investment Companies RICs and receive an exemption on the income in the Federal Republic. Foreign tax credits offset US. 61 rows The rate is 10 for interest not described in the preceding sentence and paid i by banks or ii by the buyer of machinery and equipment to the seller due to a sale on credit.

Countries with tax treaties with the US.

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

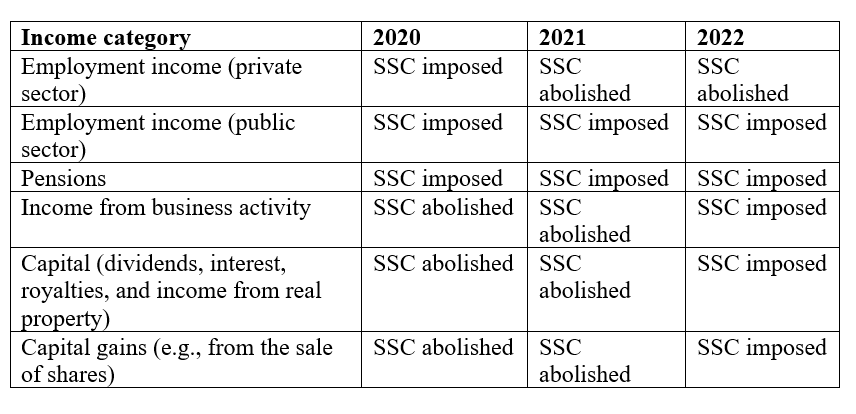

The Andorra Tax System Andorra Guides

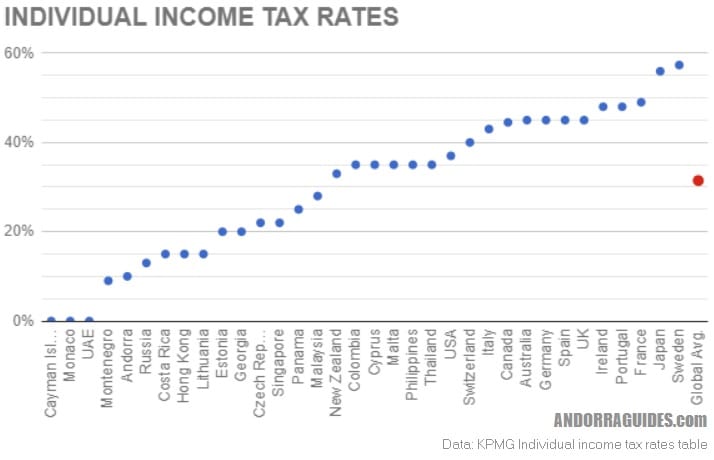

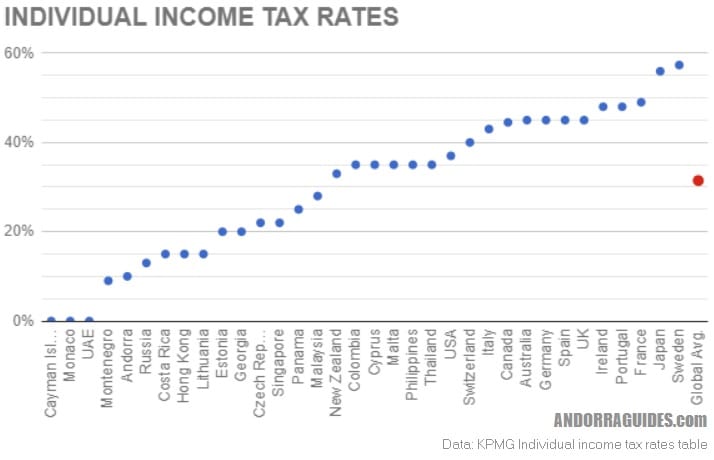

How Your Country S Tax Rate Compares To Us And The World Infographic

Doing Business In The United States Federal Tax Issues Pwc

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

What Is The Tax Percentage Paid By Businesses In Different Countries Answers Map World Map Showing Countries Slavery

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Figure A4 Personal Income Tax Rates In The Eu Download Scientific Diagram

Global Tax Rates Comparison Tax Money Havens